NewFunds S&P GIVI SA Resource 15

Related Articles

Suitability: The second specialist fund is focused on the resources sector, which has been through a rough time over the past few years as commodity prices have plummeted. This ETF is for investors who can stomach some volatility and already have a diversified portfolio (one that already includes other equity holdings, cash and bonds). ETFs that invest directly in a single commodity such as platinum are not permissible under the tax-free savings account framework in SA so these diversified funds invested in mining companies are the best way to get exposure to the commodities cycle using a tax-free account.

There are two funds you can use: the NewFunds S&P GIVI SA Resources 15 ETF and the Satrix Resi ETF. We prefer the NewFunds S&P GIVI SA because it weights 15 resource stocks based on their prospects while the Satrix Resi invests in the 10 biggest according to their market capitalisation, irrespective of prospects.

The funds give concentrated exposure to commodities companies, unlike diversified funds such as those that track the top 40 index, specialist fund constituents are likely to move in the same direction. While this is a plus during a commodity boom it can result in larger capital losses in the case of a cyclical downturn.

What it does: The ETF replicates the price performance of the S&P GIVI SA Resources Index, which represents the top 15 resource stocks from the S&P GIVI (Global Intrinsic Value Index) SA composite index of general equities. The approach selects resource counters with the highest intrinsic value and lowest volatility, subject to certain liquidity constraints. However, the maximum weight of each stock in the index is capped at 30%. “Intrinsic value” is defined as the book value of the company adjusted for future earnings prospects derived from consensus forecasts of financial analysts.

Advantages: We think the intrinsic value weighting is a more robust way to construct a portfolio than the market-cap approach. And because it gives more weight to counters that have lower risk (low volatility), it also somewhat reduces the risks involved.

Risk: There are two important risks to consider. First, the fund is concentrated in one broad sector and all companies respond to similar risk factors. It is important therefore that this ETF forms part of a wider portfolio that includes other sectors. Second, it is an all-equity investment which is more volatile than other asset classes such as bonds and cash.

Fees: The annualised total expense ratio which excludes brokerage and transactional costs for this fund is 0.16%.

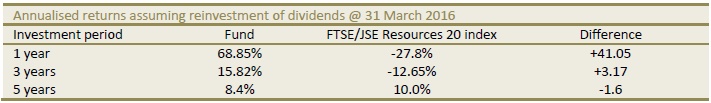

Historical performance: The fund’s performance depends on how you choose to invest – through a single lump-sum payment or regular instalments. A lump-sum investment mimics the index performance more closely. The performance report in the table below is for a lump-sum investment. The NewFunds S&P GIVI Resources 15 has outperformed the JSE Resources 20 Index since inception, which shows the impact of the forward looking approach to weightings.

Alternatives: Its closest peer is the Satrix RESI ETF which is weighted according to the market capitalisation of each company. Satrix Resi is more expensive with an annual TER of 0.45%.

Alternatives: Its closest peer is the Satrix RESI ETF which is weighted according to the market capitalisation of each company. Satrix Resi is more expensive with an annual TER of 0.45%.

Other options are single-commodity ETFs. These invest directly in one commodity, bypassing the mining companies. For example, the Absa NewGold ETF invests in gold bullion debentures which are backed by physical gold. It is a way to invest in gold without having to invest in the mining companies that produce it. However, these are not allowed in tax-free savings accounts.