CoreShares PropTrax SAPY ETF

Related Articles

Suitability: The CoreShares PropTrax SAPY, managed by Grindrod, is one of the few listed exchange-traded funds offering retail investors exposure to the commercial property market. Real estate assets have two useful sources of return: rentals that escalate annually and appreciation of the value of the property itself. Investors benefit from a high dividend yield and their role as a portfolio diversifier.

This makes CoreShares PropTrax SAPY suitable for a long-term (more than five years) investors seeking to diversify a core portfolio but also wanting a steady flow of income. While property stocks are generally regarded as a separate asset class, they are still equities and should not be used as an alternative to low-risk fixed income investments. Over the past 10 years property stocks have been about 5% more volatile than the all share index.

What it does: CoreShares PropTrax SAPY tracks the FTSE/JSE South African Listed Property Index (JSE SAPY) by holding constituent securities in the same weightings as they have in the underlying index. It provides returns linked to the performance of the SAPY in terms of both price performance and income. The FTSE/JSE SAPY Index was designed to capture the top 20 liquid property companies but due to a number of concerns from market participants, the JSE is considering revising this index and other property-related indices. The exercise is likely to result in a number of changes to the underlying constituents.

Advantages: Through a single investment, CoreShares PropTrax SAPY provides exposure to SA’s top listed commercial real estate at a low cost. Another attraction is its high dividend yield of 5.4%.

Disadvantages: With a total expense ratio of 0.57%, CoreShares PropTrax SAPY is more expensive than its closest competitor, STANLIB SA Property ETF, which charges 0.37%. Growthpoint Properties and Redefine Properties account for 38% of the fund, creating concentration risk – the performance of the fund will be biased towards the performance of these two stocks. Also, the majority of the stocks at the tail of the JSE SAPY index lack trading liquidity, which increases tracking risk.

Risk: Unlike most ETFs which usually invest in a diversified pool of assets or stocks, the CoreShares PropTrax SAPY invests solely in property stocks. This pure SA real estate market exposure makes it riskier than other non-specialist ETFs on the market and should be used to complement a core portfolio. But by the same token it has potential for higher returns.

Fees: Total expenses take 0.57% from the fund each year.

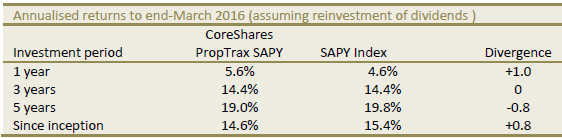

Historical performance: Property stocks have outperformed most of SA’s traditional equity and bond benchmarks for some time now. CoreShares PropTrax SAPY benefited from this strong performance in property stocks, returning 19.8% over the past five years.

Alternatives: Retail investors seeking exposure to property stocks have two other options: CoreShares PropTrax SAPY Ten Minimum managed by Grindrod Asset Management and Stanlib SA Property Exchange Traded Fund.

Alternatives: Retail investors seeking exposure to property stocks have two other options: CoreShares PropTrax SAPY Ten Minimum managed by Grindrod Asset Management and Stanlib SA Property Exchange Traded Fund.

The Stanlib SA Property ETF tracks the JSE SAPY index in a similar fashion to the CoreShares PropTrax SAPY. With over R9.2bn of assets under management the fund is by the far the largest in the sector. It also offers the cheapest exposure with a total expense ratio of 0.37%.

Investors can also get property exposure through the CoreShares PropTrax SAPY PropTrax Ten Minimum. This ETF differs from the other two discussed above in that it tracks the FTSE/JSE SAPY Top 10 equal index. It holds the top 10 companies in SAPY in equal weightings of 10% each. While it won’t be as diversified as the other two it certainly caps investments in Growthpoint and Redefine. Also, by investing only the top 10 property companies, its underlying index is likely to be more liquid. It has a total expense ratio of 0.55%.