NewFunds Shari’ah Top 40 ETF

Related Articles

Suitability: The NewFunds Shari’ah Top40 is an investment instrument created to comply with Islamic ethical investing principles. The ETF will suit investors wanting to add equity exposure to their tax-free savings account while complying with the investment principles of Islamic law. This does not necessarily mean you are forgoing returns because ethical investments may, in the long run, also be the best performing investments. However this and other ethically based investment strategies do exclude investments that could be good performers.

What it does: The NewFunds Shari’ah Top 40 Index ETF tracks the performance of FTSE/JSE Shari’ah Top 40 Index, which is jointly established by FTSE International Limited (FTSE) and JSE Limited (JSE). The FTSE/JSE Shari’ah Top 40 Index is designed to reflect the Shari’ah compliant companies identified from the FTSE/JSE Africa Top 40 Index by Yasaar Ltd, which provides independent Shari’ah compliance solutions in terms of stringent Shari’ah standards and principles.

Disadvantage: One major weakness with socially responsible investing is the limited choices with regard to portfolio diversification. This is quite evident in this ETF which, after qualitative screens, ended up being concentrated in resources. It lacks in sector diversification.

Fees: For the year to end-March, 0.31% of the average net asset value of the portfolio was incurred as charges, levies and fees related to the management of the portfolio, which is below the average cost for ETFs.

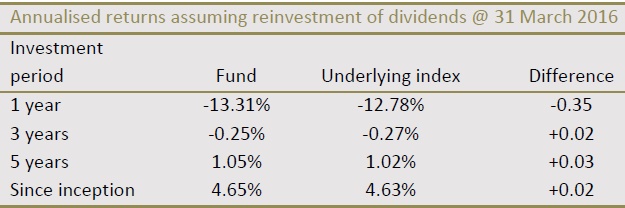

Historical performance: