Dear black tax … will I ever save?

By Leya Mall | 8 August 2018

Welcome back readers, to the Tax-Saving South African, where I walk with you in your personal finance journey through a range of financial themes

Picture this … you’ve just graduated from university, you’re the first in your family to do so and you’ve landed your first job – time to splurge on all the lavishes life has to offer. Right? WRONG! Let’s unpack the harsh realities the majority of graduates face – particularly black graduates – before they can start “treating themselves” on their first salary.

According to the urban dictionary, which keeps old timers like my editor up to date with today’s hip language, black tax is defined as the extra money black professionals pay every month to support less fortunate members of their families and extended families.

Black tax is an intrinsic part of South African culture that unfortunately is usually ignored in all forms of formal financial planning. It stems from the gratitude that young employees have towards their families for putting them through school and often university. They want to give back and support the family – this is closely linked with the spirit of ubuntu, which includes the essential human virtues of compassion and humanity in Africa. Reinforcing all this is societal pressure: often, black tax payments are expected and those who defy it are stigmatised.

The problem, though, is that the black tax places an extra financial burden on an already overstretched budget.

As we discussed in the previous column, there is greater potential in investing for the longer term. How can you budget for this when you’re trying to cut your spending by going after that 5kg rice special at Makro but also paying for your uncle’s backroom rent? Given the list of regular, unavoidable expenses listed in the table below, it becomes next to impossible to save, much less invest in your retirement annuity (RA) – which of course, you want, so that your future children will not be paying black tax to you!

|

Jim’s monthly budget |

||

| Gross income | R 21,300 | |

| Deductions (from salary slip) | PAYE Tax | (R3,060.08) |

| UIF (1% of gross income) | (R148.72) | |

| Retirement annuity* | (R3,195.00) | |

| Medical aid* | (R990.00) | |

| Subtotal | (R7,393.80) | |

| Net income | R13,906.20 | |

| Monthly expenses | Rent | (R5,844.00) |

| Electricity & water | (R1,000.00) | |

| Groceries | (R1,588.00) | |

| Public transport | (R1851.00) | |

| Cellphone | (R343.00) | |

| Start-up flat furnishing costs** | (R2,000) | |

| Once-off costs | Miscellaneous | (R1,280.00) |

| Left over (Nike fund) | Ha ha – not likely | |

| Subtotal | (R13,906.20) | |

| Total expenses | (R21,300) | |

| Black tax | ? | |

*Not compulsory

** Calculated as 12 monthly repayments for total cost of furniture

Before we use a scenario of budgeting for black tax with an example of a monthly budget, lets discuss some steps to cope with the pressures of black tax.

Step 1: Draw up a monthly budget (see table below).

Step 2: Work out a list of individual expenses after deductions (see budget examples).

Step 3: Speak to your family about the amount you can contribute and find ways to secure financial aid for your family (school scholarships, government schemes and the like).

Step 4: Be financially savvy by planning, saving and investing by checking out https://savetaxfree.co.za/.

Step 5: Take things in your stride: your happiness matters and financial stress should be addressed.

So let’s take a “Jim comes to Joburg” scenario and see if we can budget in a little extra for those Nike sneakers he so “desperately needs”.

Jim, from Joza in Makhanda (formally Grahamstown), made the most of his scholarship and recently graduated from Rhodes University with a BCom. His new job in Johannesburg earns him R21,300.00 a month which, according to Trading Economics.com, is a “high-skilled” salary in SA. The table above reflects Jim’s monthly budget – and of course the stressed budget with the very small surplus reflects the difficulties of all people in this income bracket, regardless of race.

The RA monthly payment is 15% of Jim’s monthly income – the recommended amount to save in an RA, but remember you get tax benefits if you pay up to 27.5% of your salary. The medical aid payment is based on an entry-level plan while the other expenses are based on the typical percentage a person pays for each, according to Business Insider.

Immediately we can see that the expense figures are not practical. Jim’s regular monthly payments eat up most of his disposable income, leaving just R1,355.00. That will be eaten up quickly through miscellaneous once-off costs: Jim still needs to buy work clothes, which he’ll probably need to pay off over six months or a year – and still factor in entertainment and any unplanned costs.

So if Jim had some spare change besides the miscellaneous expenses, a tax-free savings account (TFSA) and not the Nike fund would be ideal. BUT, that black tax factor has not magically disappeared.

To contrast, the difficulty of budgeting for black tax, the table below is an example of a budget for a middle class working adult in South Africa. It is based on the same typical percentages in the Business Insider estimates for the average household.

| Middle class adult monthly budget (per spouse) | |||

| Gross Income | R 42,600 | ||

| Deductions (from salary slip) | PAYE Tax (36% of gross income) | (R9,820.00) | |

| UIF (1% of gross income) | (R148.72) | ||

| Retirement annuity* | (R6,390.00) | ||

| Medical aid* | (R990.00) | ||

| Subtotal | (R17,384.72) | ||

| Net income | R25,215.28 | ||

| Individual expenses | Bond payment on house | (R13,121.00) | |

| Groceries | (R3,229.00) | ||

| Petrol | (R1,513.00) | ||

| Cellphone | (R283.00) | ||

| Internet | (R500.00) | ||

| Private school fees (1 child) | (R4,000.00) | ||

| Children’s expenses | R8757.58 | ||

| Once-off costs | Miscellaneous | R512.00 | |

| Subtotal | (R25,215.28) | ||

| Total expenses | (R42,600.00) | ||

| Black tax | ? | ||

*Not compulsory

The outcome of the surplus in the form of miscellaneous once-off costs is only R512.00 per spouse – so even higher income earners struggle to save as expenses balloon significantly in the monthly salary deductions. This begs the question, should middle class income earners also get themselves into debt to be able to afford this black tax?

Source: South African Reserve Bank.

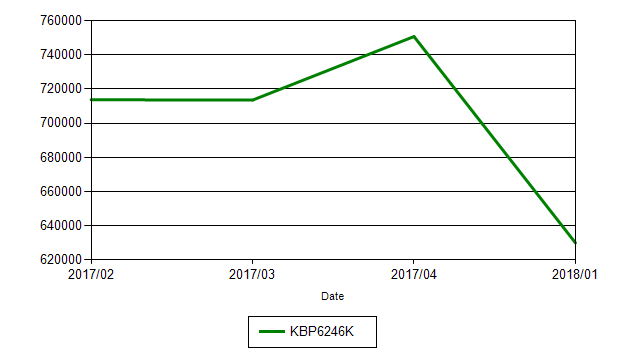

The graph shows how, as a nation, South Africa’s savings rate has declined dramatically, from 7% of disposable income in 1987 to zero in 2017 – after spending some time in negative territory around 2013.

Disposable income of households graph in (R)millions

Source: South African Reserve Bank

Source: South African Reserve Bank

South Africa’s economy is in dire financial straits and consumers are buckling under the weight of the increased VAT rate and fast-rising petrol prices. Disposable incomes are under huge pressure. Things are unlikely to improve anytime soon and costs will keep rising, probably faster than wage growth.

With 57,3% of SA’s youth being unemployed, according to StatsSA, it means 42.7% are employed and many will be in a similar financial situation as poor Jim. As we have seen, there is no extra money, so is a black tax is not economically viable.

Essentially, Jim cannot establish himself with a house and car without financing his lifestyle by getting into debt, bearing in mind that for all his good intentions of giving back to his community, the community may not give back to Jim.

Continue following this series to become a wiser tax-saving South African!