CoreShares PrefTrax ETF

Related Articles

Suitability: The CoreShares PrefTrax is the only ETF on the JSE which offers investors exposure to the pool of publicly traded preference shares. A preference share is a class of ownership in a company that has a higher claim on assets and earnings than ordinary shares, but less of a claim than debt. They generally have a dividend that must be paid out before dividends to ordinary shareholders.

Preference shares are regarded as hybrid instruments as they share similar characteristics with both debt and equity. In SA, a dividend withholding tax of 15% is paid on dividends earned from preference shares, giving them a tax advantage over bonds and money market instruments which are taxed at the marginal income tax rate of the taxpayer once the interest exemption of R23,000 a year is used up. However, in a tax free account both returns should be tax free. Outside of a tax free account, this tax advantage makes CoreShares PrefTrax shares appeal mainly to high net worth, income-focused investors. Share capital appreciation is limited, so when investing in this ETF your main aim should be to generate income over a long period.

What it does: CoreShares PrefTrax tracks the FTSE/JSE preference share index in the same weightings in which they are included in the index. The JSE preference share index measures performance of non-convertible, floating rate perpetual preference shares (these are the most standard form of preference share which cannot be converted to ordinary equity, or recalled by the company).

Advantages: The main attraction of preference shares as an asset class is their attractive after-tax yield. Historically SA preference shares have outperformed bonds and money market instruments on an after-tax yield basis. Historically, preference shares have appealed to tax-sensitive investors as dividends received were tax exempt until the introduction of the 15% withholding tax in 2013. That has dented their attractiveness but they still hold tax advantages.

Another benefit of this ETF is that if there is no willing buyer when you want to dispose your units, Grindrod, the ETF issuer, will step in as the counterparty.

Disadvantages: One of the main criticisms of preference shares following the collapse of African Bank is that holders have all the downside risk of equity but limited upside benefits. Preference shares are ranked below debt on the risk hierarchy of a company’s balance sheet. In the event that a company is wound up, first in line are holders of senior debt, followed by senior unsecured debt and subordinated debt. However, pref shareholders do rank above ordinary shareholders. Following protracted negotiations, holders of African Bank’s preference shares will be getting around a third of their money back. African Bank, however, formed a very small component of the overall pref share index.

Risk: As with all investments, there are certain risks to investing in CoreShares PrefTrax. First is the index tracking risk – the ETF’s returns may not match the index returns. Second, while Grindrod stands ready to provide liquidity for investors willing to sell their units of thisETF, investors are still exposed to capital risk.

Fees: The fund’s total expense ratio is 0.57%, which is within the range of other ETFs.

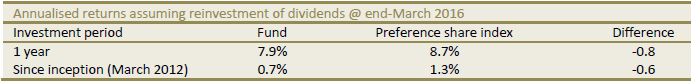

Historical performance