Ashburton Top40 ETF

Related Articles

Suitability: Ashburton Top40 is a solid ETF choice for investors seeking steady returns and decent income but who can tolerate the risk associated with equity investments. It has been one of the best-performing funds in its category and offers among the lowest fees. It tracks a diversified index and can be considered as a core investment for the long term.

What it does: The fund tracks the JSE top 40 index, investing in the 40 largest listed companies. It weights its holdings by market capitalisation, so the bigger the company, the bigger percentage is invested in it. This means if Naspers accounts for 12% of the total market cap of the top 40 companies, then RMB Top40 will have 12% of the portfolio invested in Naspers. The Top 40 Index is weighted on quarterly basis which helps minimise trading expenses for the fund.

Advantages: The ETF offers easy access to the largest companies on the JSE through one investment. Many of the biggest companies on the JSE earn a significant portion of their earnings outside SA. The rand’s severe devaluation over the past few years, accelerating over the past few months, means foreign earnings are increased substantially when exchanged into rands.

Disadvantages: Market capitalisation weightings skew the portfolio towards the largest stocks, which might not necessarily be cheap ones. However, tracking the market-cap weighted top 40 index and rebalancing four times a year helps to ensure low turnover and reduce risk.

Risk: This is a 100% investment in equities, which is a riskier asset class than bonds or cash. It is likely to be volatile, but the returns should compensate for volatility in the long run. We think the sectoral and geographical diversity of the constituent companies as well as the fact that they are blue chip counters with good track records does diminish the risks to a degree.

So if you are an investor seeking general market performance through a well-diversified equity portfolio at low cost with decent dividend payments, then the RMB Top40 ETF is likely to be suitable.

Fees: Fees take a total of 0.16% out of RMB Top40’s returns each year, a comparatively low cost. For every R1 000 invested in the fund, 160c goes to fees. This ETF offers the lowest fees in its category and also engages in securities lending. Securities lending is the practice of lending out of the fund’s underlying holdings in exchange for a fee. A large portion of the proceeds are passed on to investors, which partially offsets the fund’s expenses.

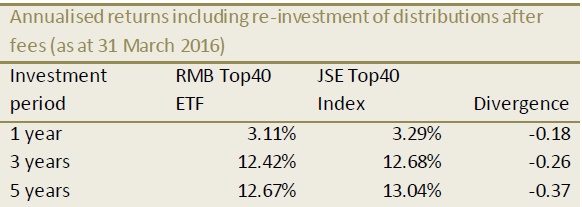

Historical performance: