NewFunds S&P GIVI SA Financial 15 ETF

Related Articles

Suitability: The idea behind subsector funds is that they allow you to fine tune your exposures depending on your views of the likely prospects for different sectors. They can also be “building blocks” to assemble a portfolio with different sectors weightings from those found in broader diversified portfolios. These funds suit more active investors who want to take a view on the prospects for different segments of the economy. For less active investors, a broader fund with wider exposures is probably more appropriate, such as the NewFunds Swix 40 and the Satrix Divi.

Absa’s NewFunds S&P GIVI SA Financial 15 is one of two ETFs listed on the JSE which provide exposure to the financial sector, the other being the Satrix FINI. They use different approaches. The NewFunds ETF is weighted by intrinsic value, and intrinsic value is derived from projected future cash flows, which the fund issuer calculates. The ETF invests in the 15 financial companies with the best projected cash flows and the lowest volatility. The Satrix fund invests in the 15 biggest financial companies according to their market capitalisation (excluding locked-in shares such as those held by promoters, founders and governments). The NewFunds ETF therefore is similar to a more actively managed fund in which a fund manager takes active decisions based on their view of prospects for companies while the Satrix fund is passive in tracking the index.

What it does: The fund replicates the price performance of the S&P GIVI SA Financials Index, an index which represents 15 stocks from the S&P GIVI SA composite, constructed using GICS financials sector classification (see below for a key to this alphabet soup). The approach favours counters with the highest intrinsic value and lowest volatility, subject to certain liquidity constraints. However, the maximum weight of each stock in the index is capped at 30%.

Here is what the acronyms stand for:

- GIVI stands for Global Intrinsic Value Index

- GICS means Global Industry Classification Standard. It is a globally accepted asset classification methodology (a way of deciding whether a stock is a “financial” or “industrial” for example) developed in 1999 by Morgan Stanley Capital International (MSCI) and Standard & Poor’s (S&P).

Advantages: Because the fund uses intrinsic value as a determining factor for its investments, it means it is forward-looking, based on the expected performances of each company. We think this is a more robust way to construct a portfolio than the market-cap approach. And because it gives more weight to counters that have lower risk (low volatility), it also somewhat limits the potential loss of capital.

Disadvantages: Although it tries to limit the idiosyncratic risk of individual assets by capping them at 30% of the portfolio, we think the cap is too high and performance of the fund could potentially be skewed by one asset. However, the fund’s weightings do not reflect this.

Risk: There are two important risks to think about. First, the fund is concentrated in one broad sector and all companies are very responsive to similar risk factors. It is important therefore that this ETF forms part of a portfolio’s wider equity holdings that also include other sectors such as an industrial stocks. Second, it is an all-equity investment which is more volatile than other asset classes such as bonds and cash.

Fees: The total expense ratio is 0.12%. This excludes brokerage and transactional costs.

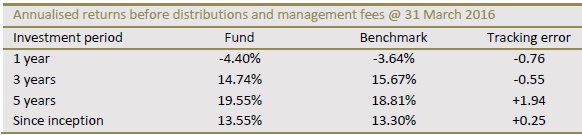

Historical performance: The fund’s performance depends on the method used to invest. A lump-sum investment closely mimics the index performance. However, investing through regular instalments usually lags the performance of the index, according to historical evidence, and the pattern is apparent in other ETFs too. This supports the need to invest for longer periods when it comes to equities. The performance described in the table below is for a lump-sum investment.