The ETF Monthly Review: June 2018

Related Articles

The ETF Monthly Review: June 2018

Welcome to this month’s ETF Review, a neat update of market news affecting ETFs, as well as a set of favourite funds chosen by the Intellidex team. EasyEquities and Intellidex are collaborating to bring you the latest insights on ETFs, the ideal equity investment medium for tax-free savings accounts.

IN THIS ISSUE:

What’s happened in the markets?

- Trade tensions escalating

- SA economy contracts in first quarter

Our favourite ETFs

- Domestic equity: Satrix SA Quality ETF

- Foreign equities: Ashburton Global 1200 and Satrix MSCI Emerging Markets

- Bond & cash: NewFunds TRACI 3 Month (short term); Satrix ILBI ETF & Absa NewFunds Govi (long term)

- Dividend or income funds: Satrix Property ETF

New international-asset ETFs

The surge in the listing of international-asset ETFs continues, with Stanlib and Satrix the latest firms to add to the menu.

What’s happened in the markets?

ETFs struggled during May with an equally weighted portfolio of the 60 ETFs that reported returns losing 2.32%. Local-asset ETFs performed poorly while the international ones were positive.

Local funds and markets:

The see-saw theme that has characterised the local equities market since 2014 continued in May with the all share index reversing gains of the previous month to contract 3.5%. The top 40 index –the universe for most of the local equities ETFs – retreated 3.1%. Only resources shares continued with April’s upward momentum. The two funds that invest in the sector, Satrix Resi 10 and S&P Givi Resi, rose 4.1% and 3% respectively.

Bond funds were muted and edged up marginally with all ETFs in the category returning less than 0.1%. And the only money market ETF gained 0.6%.

The poor performance of equities mirrors economic data which has been largely disappointing. Although inflation came in lower than expected, the continued rise in the fuel price and the weakening rand could trigger monetary authorities to raise interest rates to tame inflationary pressures.

Intellidex’s favourite ETFs

Each month the investment gurus at Intellidex scan the market to come up with a list of their favourites.

Phibion Makuwerere, CFA, explains:

We classify all ETFs into five broad categories:

• domestic equity;

• international equity;

• bonds and cash;

• multi-asset; and

• dividend-focused.

We also split international equities into developed and developing markets. Not all categories are right for all investors; you want to choose asset classes that meet your unique risk profile.

We believe a good ETF should be cheap. Cost differences, while appearing small on paper, can make a huge impact on an investor’s returns when compounded over time. We also like ETFs that follow a simple but watertight investment philosophy. They should also be tax-smart, which means they should qualify to be in a tax-free savings account. Generally, to avoid overconcentration, a good ETF should cap its exposure to a single sector and/or a single counter. Below we provide an overview of our favourite funds for each category. Generally, they are the same funds from month to month and we make changes to this list when new and better ETFs (in terms of the criteria explained above) are listed, fees change or there is some other fundamental change.

The June favourites:

Domestic equity: Satrix SA Quality ETF

Satrix SA Quality remains our choice but it has performed poorly in the past few months, declining 7% in May. However, investors should take comfort in that equities experience short-term volatility but should accumulate returns ahead of inflation and other asset classes over longer periods.

From the big batch of domestic broad-based equity funds on offer, we like this ETF because it reduces the concentration risk that has come to dominate the top 40 index because it caps the weight of each counter and sector. The fund selects constituent companies using a set of quality metrics, including

Credit rating agency Standard & Poor’s maintained SA’s sovereign credit ratings but remains worried about the poor growth numbers. These worries were accentuated by the surprise 2.2% shrinking of the economy in the first quarter. Exacerbating SA’s economic picture is the recent three-year public sector wage agreement which exceeds by R30bn the R110bn provision for salary adjustments made in the 2018 Medium Term Expenditure Framework.

While the “Ramaphoria” effect has come to a screeching halt, it does not mean the sky is falling but it makes the need for economic reforms more urgent.

International funds and markets:

Most international funds closed May in positive territory. The best performances came from the CoreShares S&P500 and newly listed Stanlib S&P500 – they track the S&P500 and climbed 6.3% and 8.5% respectively. These metrics correlate with positive economic indicators coming out of the US reflecting expansion and jobs growth. The US Markit flash manufacturing purchasing managers’ index (PMI) increased only marginally but hit 56.6 points, its highest level since September 2014. The services PMI increased to 55.7 from 54.6 in April.

return on equity, liquidity and the leverage of the balance sheet. The top 20% of all JSE-listed companies with the highest scores based on those criteria are included in the fund and weighted by market capitalisation, then capped each at 10% of the fund. Empirical evidence shows that portfolios sorted on factors such as profitability and earnings quality generate high risk-adjusted returns relative to a market portfolio. However, the size of the premium varies, depending on the metrics used to calculate the quality score.

Foreign equities, developed markets: Ashburton Global 1200 ETF

Less than a year old, this fund returned 2.7% in May, buoyed by US stocks which command the lion’s share of this globally diversified fund. Europe and Japan disappointed.Most diversified global funds tend to be overweight in US equities, reflecting their dominance in global equities markets in terms of capitalisation. However, we maintain our exposure to this fund because in addition to the US, it gives exposure to other developed markets: S&P 500 (US); S&P Europe 350; S&P TOPIX 150 (Japan); S&P/TSX 60 (Canada); S&P/ASX All Australian 50; S&P Asia 50; and S&P Latin America 40.A number of international-asset funds have been added since the beginning of the year – Satrix and Stanlib

However, Sygnia’s EuroStoxx50 fund was clobbered, falling 4.5% and its MSCI Japan ETF lost 0.6%. This is in line with disappointing eurozone and Japan April PMI readings.

Emerging markets were also under pressure, with the Satrix MSCI Emerging Markets ETF retreating 1.98%. Similarly, the Cloud Atlas African fund lost 1.87%. There are mixed signals coming out of China, including weaker-than-expected fixed investment and retail sales in the first four months of the year. On a brighter note, industrial output accelerated in April after slowing in March.

However, the Trump-sparked trade war is accelerating, which is weighing on most global markets. The higher tariffs imposed by the US, mainly on steel and aluminium imports, are particularly affecting China, but also its North American Free Trade Agreement (Nafta) and eurozone partners. A “tit-for-tat” approach could change the face of global trade policy and ultimately weigh on global growth.

At the weekend, US President Donald Trump upped the ante with global trade relations after he rescinded support for a joint G7 statement – which emphasised unity and a commitment to trade. In his twitter response, Trump hinted at further tariffs and called “Fair Trade … Fool Trade if it is not Reciprocal” after the US put up with “Trade Abuse for many decades”.

[Ends]

recently added six funds between them. (In the returns graph, funds without a 1-year return are new funds.)

Foreign equities, developing markets: Satrix MSCI Emerging Markets ETF

The choice in this segment is limited to two funds: Satrix MSCI Emerging Markets (-1.98% in May) and the Cloud Atlas AMI Big50 (-1.87% in May). Our choice for Satrix MSCI Emerging Markets is motivated by its diversification. The fund provides exposure to high-growth economies such as China and India, which are not included in any of the developed market funds, thus offering further diversification. The Satrix MSCI Emerging Markets ETF tracks the MSCI Emerging Markets Investable Markets index, which captures companies across 23 countries.

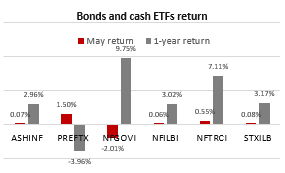

Bond and cash funds

Bonds and cash are good additions to portfolios not only because of their diversification qualities but also for their ability to enhance returns.

If you are investing for a very short period, usually less than a year, then the NewFunds TRACI 3 Month (NFTRCI) is a natural choice because it is least sensitive to sudden adverse interest rate movements. It is similar to earning interest on your cash at the bank with a minimal possibility of capital loss. Its return was 0.6% in May.

However, for a longer investment horizon, protecting your investment against inflation is paramount. We therefore maintain our choice of the Satrix ILBI ETF. Less than a year old, it promises to have the lowest expense ratio of 0.22% compared with peers. It edged up by 0.08% in May.

Furthermore, nominal bonds add a unique risk-return dimension – that differ from inflation-linked bonds – which improve overall portfolio performance. The only fund in this category is the Absa NewFunds Govi.

Dividend or income theme funds

If you rely on your investment income for day-to-day expenses you may want to allocate a portion of your portfolio to ETFs that have a high distribution ratio. Naturally, Satrix Dividend Plus and CoreShares S&P South Africa Dividend Aristocrats come to mind here, but similarly, property funds are high dividend payers.

There are two investable property indices available: SA listed property and the capped property index. We maintain our choice of the capped fund Satrix Property ETF, with lowest expected TER in the segment.

The property sector has fallen on hard times lately but we believe that is temporary. The Satrix Property fund made a loss of 4.11% in May

Multi-asset ETFs

If you find the process of diversifying your portfolio daunting, two ETFs do it for you. They combine equities and bonds to produce a diversified portfolio for two investor archetypes. They are the NewFunds Mapps Protect ETF and the NewFunds Mapps Growth ETF. They are designed to meet two different risk appetites: Protect is more conservative, suitable for conservative savers. Growth suits investors with a long-term horizon. Mapps Growth and Mapps Protected lost 3.7% and 2.1% respectively during May.

New international ETFs

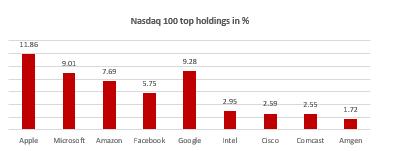

The surge in the listing of international-asset ETFs continues, with Stanlib and Satrix the latest firms to add to the menu. Satrix’s themes are already covered by other listed funds in some form, but Stanlib’s Nasdaq 100 ETF is of particular interest. The fund is made of the 100 largest companies listed on The Nasdaq Stock Exchange based on market capitalisation. The index reflects companies across major industries including computer hardware and software, telecommunications, retail/wholesale trade and biotechnology. However, the fund excludes securities of financial companies including investment companies. The Nasdaq is known to accommodate smaller companies that do not meet requirements of other exchanges. It is also tech-heavy.

Unlike other international indices such as the S&P500 and MSCI US, it gives a lot of weight to technology companies.