Offshore trackers a smart move in face of rand’s decline

Related Articles

By Nonhlanhla Kunene

By Nonhlanhla Kunene

With the rand’s alarming decline the argument for offshore investments becomes compelling. The currency has lost 26% so far this year and nearly 60% in three years and expectations are that it will devalue further once the US raises interest rates.

And with the dollar showing no signs of slowing down against the rand, Judy Padayachee, technical analyst at Barclays Capital, feels now is as good a time as any for South Africans to consider diversifying through offshore investments.

“At this stage the dollar is still going strong, which makes it a good time to invest offshore. In fact, based on our analysis, there are strong indications that the rand is going to continue to weaken and may possibly fall as low as R14.80 to the dollar. The rand is subject to global factors, including sentiment, so until there is a global turn towards emerging and commodity-based markets, the rand will continue to weaken,” says Padayachee.

The introduction of exchange traded funds (ETFs) in late 2000 and tax-free savings accounts (TFSAs) earlier this year has made offshore investing hassle free by minimising the bureaucracy traditionally associated with it.

The avenues available to South Africans to invest offshore are plenty. However, as the only provider of rand-denominated offshore ETFs, Deutsche Securities’ offering of offshore tracker funds, known as db X-trackers, has made cost-effective, tax-free investments with offshore exposure a hassle-free possibility to all South Africans.

Tracker funds, as the name suggests, are funds that track or follow specific market indices with the aim of duplicating their performance. Tracker funds are classified as passive investments because their underlying investments are pre-determined with limited or no maintenance from a manager. They simply track the investments making up the relevant index.

The options available through the db X-trackers range include the db X-trackers Eurostoxx 50 Index ETF which tracks the EURO STOXX 50 index, the db X-trackers FTSE 100 Index ETF (FTSE 100), db X-trackers MSCI Japan Index ETF (Japanese market), db X-trackers MSCI USA Index ETF (US market) and the db X-trackers MSCI World Index ETF (global developed economies). For more information click here.

What separates db X-trackers from similar investment options is their ability to offer investors the advantage of an established rand hedge without having to switch currencies, obtain an offshore account or a tax clearance certificate. While the concept of a rand-denominated offshore investment is not unique, with various LISPs offering their own range of rand-denominated offshore unit trusts, such as Old Mutual’s Global FTSE RAFI All World Index Feeder Fund, db X-trackers are currently the only local provider of offshore ETFs in South Africa that qualify as tax-free savings accounts.

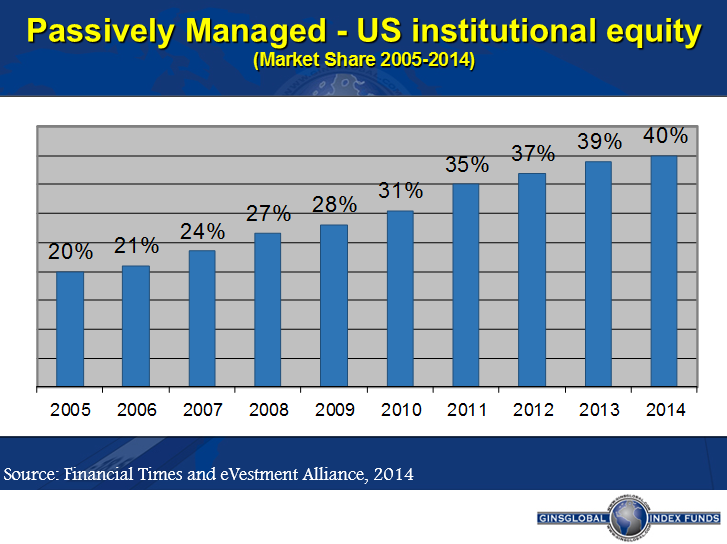

Besides the added benefits of a tax-free investment, Wehmeyer Ferreira, head of Deutsche’s db X-trackers, feels that what makes them an attractive investment option is the fact that they are passively rather than actively managed. “With actively managed investments, most investors think they can pick a winning manager but often fail, so there is a case to be made for picking a passive investment when investing offshore,” says Ferreira.

Being passive means Deutsche Securities are able to offer them at a low annual fee of 0.855% and there are no performance fees to factor in. This lower fee profile ensures that investors get more upside and reduces the erosion of returns significantly in the long run.

“The fact that they are passive makes db X-trackers a great product for TFSAs as your investment does not need to be constantly monitored to ensure that it is not underperforming, you simply get the market return, whereas an actively managed investment has to be frequently checked in order to assess performance.”

“The fact that they are passive makes db X-trackers a great product for TFSAs as your investment does not need to be constantly monitored to ensure that it is not underperforming, you simply get the market return, whereas an actively managed investment has to be frequently checked in order to assess performance.”

For less experienced investors, Ferreira suggests the db X-trackers MSCI World Index ETF as it offers the highest level of diversification as it is invested across multiple geographies rather than one specific region. For more sophisticated investors, the other four ETFs offer an opportunity to invest directly into specific regions should they have a particular preference. Of these four ETFs the db X-trackers MSCI USA Index ETF has attracted the highest inflows.

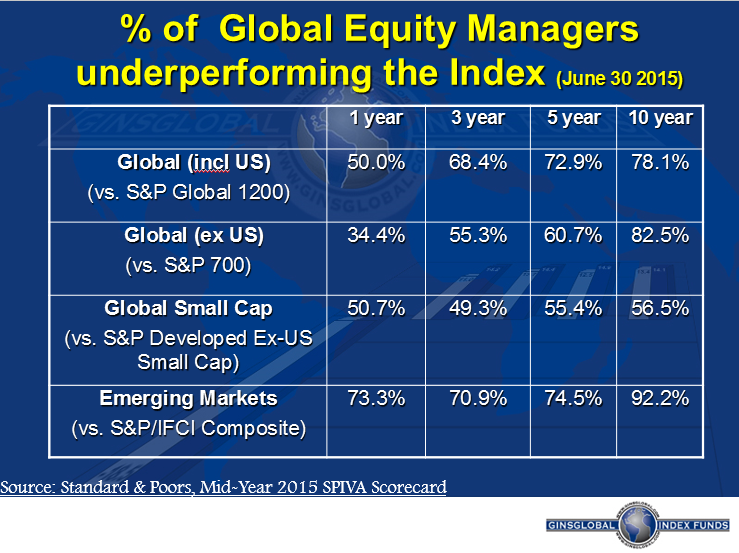

Lisa Segall of GinsGlobal suggests the reason tracker funds have consistently outperformed fund managers overseeing global portfolios has to do with the sheer size of global markets. “South Africa makes up only 1% of the global economy so it’s easy to understand why active managers in a small economy such as ours, which is still dominated by a few companies, are able to successfully outperform local indices as they are easier to track.”

GinsGlobal is the first company to market a range of FSB-approved offshore foreign index trackers as locally registered unit trusts. However, they cannot be held in TFSAs as they are not rand denominated.

Segall says the sheer size of global indices, however, makes it difficult for any one company to dominate, and the fact that information on the companies listed on these markets is so easily accessible, makes them difficult for any manager to maintain a sustained performance edge over the long-term.”

Although Segall’s views are backed by extensive research from various sources, she is quick to point out that her argument should not be viewed as being about passive versus active, but more about equipping investors with information that is easily understandable, thus enabling them to make informed decisions.

Although Segall’s views are backed by extensive research from various sources, she is quick to point out that her argument should not be viewed as being about passive versus active, but more about equipping investors with information that is easily understandable, thus enabling them to make informed decisions.

“Index trackers aim to duplicate index performances as closely as possible, so can never beat them, which means that we cannot make exaggerated claims about performance but can only demonstrate the long-term advantages of tracking the market as opposed to trying to beat it through an actively managed investment which is likely not to deliver,” she says.

Apart from never beating the index, another drawback is a lack of flexibility as investors cannot pick companies to invest in, but are forced to invest in all the companies represented in the index. Despite the lack of flexibility, Segall feels it is worthwhile to note that as an investor, you would still be gaining access to cutting-edge companies such as Google and Facebook.