How to start investing with R1000

Related Articles

Nonhlanhla Kunene | 21 October 2016

South Africans are notorious for living above their means and failing to save.

While some may attribute this to a consumer culture characterised by indiscriminate overspending, the 2015 Gauteng City-Region Observatory Quality of Life Survey gives a different perspective. With 78% of its respondents feeling saving was “difficult to impossible”, it suggests that a sizable portion of the population simply cannot afford it.

Add to that the general perception that investing is for “wealthier” people, and the fact that investment products simply don’t “talk to” the younger millennial generation, and you start understanding why so many South Africans are struggling to save.

FedGroup Life CEO Walter van der Merwe says investing does not only have to be for wealthy people. He believes the only difference between good and bad investors is the discipline to live within their means and invest the money they save at the end of every month, even if it is only a few rands.

The introduction of numerous new age investment vehicles such as exchange-traded funds (ETFs) and tax-free savings has made saving and investing more affordable and accessible. Technological innovations in the industry have made it possible for individuals start investing with negligible sums, even less than R100 a month.

But how does the average cash-strapped South African begin to invest on a budget of say R1,000? What would be the best way to kick-start a killer investment portfolio on a shoestring budget?

Anthony Katakuzinos, Stanlib retail chief operating officer, believes most people need to understand that saving is not only about putting away lump sums as this could prove difficult and challenging for many. For investors starting with small amounts, Katakuzinos feels that time in the market is more important than the amounts being invested, but investors need to stick to some key principles:

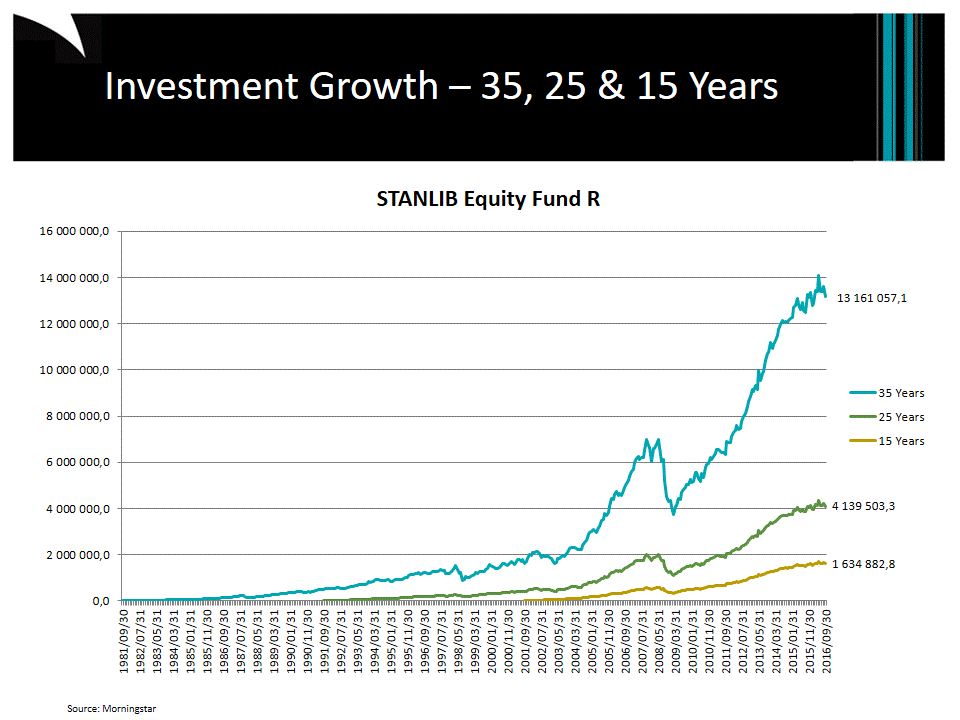

- Start saving at an early age and commit to saving consistently. If you wait for 10 years before you start saving, it will be near impossible to catch up on the returns you could have received over that time. So if you invested for 35 years at R1,000 a month you would accumulate R13m. If you started 10 years later and invested R2,000 a month, you will accumulate only R4m. That is the power of compound interest and why you will find it extremely difficult to catch up, as illustrated in the graph below:

Be prepared to save for a longer period if you want positive returns on your savings. The longer you save the more evident the magic of compound interest to your savings. You can save as little as R1,000 a month and by investing in growth assets over the long term you will earn inflation-beating returns

- Be willing to save any reasonable amount that makes sense on a monthly basis. By saving a smaller amount over a longer period you learn to live with R1,000 less a month. You will benefit significantly over the long term.

To invest on the stock exchange, Van der Merwe suggests it would be more sensible to invest larger amounts at intervals than smaller amounts on a regular basis. He believes the problem with investing on the stock exchange is that every time you buy or sell stocks, you pay fees, hence his view that it should be done at intervals. This is where tax-free savings accounts are ideal.

“I would advise that the R1,000 is saved in an account that offers good interest and low bank charges, and then save small monthly amounts into this account until the deposits and interest reach around R5 000.”

This money, he says, can then be invested on the stock exchange in an index tracker or other product that can give above-inflation returns.

“You can then repeat the process until you have another R5,000 to invest in the same manner, allowing you to consistently build your portfolio over time. Over the long term, you will be surprised at the amazing growth you can achieve with just a little bit of patience and perseverance.”

And what investment products or asset classes would give the investor maximum value for his/her investment, given the limited resources?

Van der Merwe believes that investors should start their portfolio with safer investments, such as index tracker funds which provide smoother, more predictable returns.

He says only once investors are comfortable in understanding the market should they invest in individual stocks – if they feel that they understand the company that they’re investing in. “As the portfolio grows, one may also look at diversification into other investment vehicles.”

The different investment vehicles people can use, says Katakuzinos, include banks, money market accounts and growth assets such as balanced and equity unit trusts. “Banks and money markets experience little volatility, but there’s a risk that these investment vehicles fail to keep up with inflation over time.”

He says that although growth assets such as equities grow faster over time, they need investors to be patient. They also run the risk of high volatility over a short-term investment period. “Short-term investment in growth assets, say one to two years, could yield negative returns. In a long-term investment, say five to 15 years, investors can expect inflation-beating returns.”

Growth assets in which people can invest in include equity funds, index funds and balanced funds. A unit trust tax-free savings account could be ideal, he says.

“You need to choose a flexible tax-free account. Remember a tax-free account will be with you for a very long time. Unit trust tax free accounts offer flexibility and the returns are obviously tax free.

He adds that the compounding effect of avoiding all taxes on an investment is substantial: such accounts can grow to R1.5m plus over 15 years if you invest the maximum R30,000 a year. The tax-free benefit can boost the return of a typical unit trust by up to 2% a year.