ETF Review: Spotlight on the Ashburton Inflation ETF

Related Articles

Intellidex | 12 December 2017

Every week Intellidex reviews an ETF fund for EasyEquities. See previous reviews we’ve done here.

The politically seismic events that recently occurred in Zimbabwe serve as a strong reminder of the importance of protecting investments against inflation. Our northern neighbours experienced stratospheric inflation levels a decade ago, plunging the economy into crisis and forcing the country to adopt the US dollar as its de facto currency. One moment people felt they could retire on their savings, and the next moment their savings were valueless.

Inflation-linked bonds are one way to protect against inflation. In simple terms, both the principal and the interest received is adjusted according to the level of the South African consumer price index. Investing in them means you would never see your savings damaged by inflation.

The Ashburton Inflation ETF is one of three JSE-listed inflation-linked ETFs. The other two are the NewFunds ILBI ETF and Satrix Inflation Linked Bond ETF. The issuer ensures that there is liquidity in the ETF so it is easy to buy and sell, unlike holding actual government bonds which come in large denominations and can be difficult to trade. Bonds are uncorrelated with share prices, so these ETFs can be used in a portfolio to diversify exposures and improve the overall risk profile of a portfolio. They are not risk free, as they are still exposed to the risk of changes in market interest rates, but are significantly lower risk than equity assets.

What it does:

This ETF holds a portfolio of different inflation-linked government bonds with slightly differing terms, but the general feature of the bonds is that the returns increase when inflation increases, and vice versa. Both the principal, which is the amount that the holder will receive when the bond matures, and the six-monthly payments that are made to holders of the bonds, adjust with the consumer price index. For example, if the principal is R1m and inflation is 5%, it will grow to approximately R1.62m over 10 years, with the 5% compounding every year. The interest that holders receive also adjusts with inflation because it is calculated as a percentage of the principal.

The market, however, prices the bonds according to expectations about future inflation rather than current inflation. If buyers think inflation is rising the prices of inflation-linked bonds will rise. So it is best to see inflation-linked bonds as a way of protecting against unexpected upward inflation rate changes. The ETF then provides a way to protect against an inflation shock in the future but it is vulnerable to inflation expectations adjusting downwards.

The Ashburton Inflation ETF tracks the performance of the government inflation-linked bonds index (GILBx), which is a weighted basket of South African government inflation-linked bonds. The NewFunds and Satrix ETFs two track slightly different indices. The NewFunds ILBI ETF tracks the performance of the Barclays/Absa South African government inflation-linked bond index (ILBI), which is also a weighted basket of South African government inflation-linked bonds. The Satrix Ilbi tracks the performance of the S&P South Africa sovereign inflation-linked bond 1+ year index, which is a market-weighted index that tracks the performance of rand-denominated inflation-linked securities issued by the government for the domestic market.

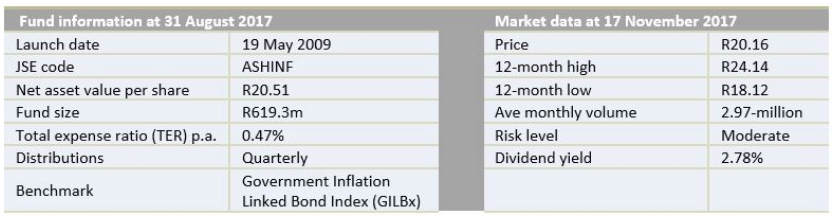

Performance review: The table below compares the Ashburton Inflation ETF against its benchmark. It lost 0.39% in the 12 months to end-August.

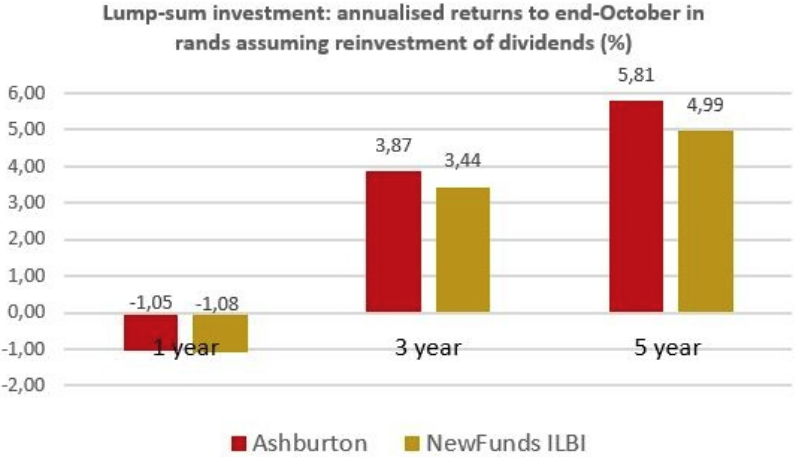

The following graph is more current, comparing returns to end-October with the NewFundsIlbi. ETF. The Satrix fund has only been in existence for less than a year and is not included.

Outlook: Inflation-linked bonds will perform best when inflation expectations are increasing. The market will price the bonds higher because investors are expecting the yield on the bonds to improve relative to their fixed yield cousins. However, if inflation expectations are declining, the bond prices will fall as fixed rate bonds become relatively more attractive. That explains why returns have been negative on a one year view.

SA’s main inflation drivers include oil prices, weather conditions and the exchange rate. Oil prices drive transportation and some energy costs while weather conditions affect food prices. Oil prices have risen lately, counteracted by weather conditions have been positive, but the rand’s recent weakness has pushed inflation in an upward trajectory. The Reserve Bank’s inflation-targeting mandate takes all these factors into account in using monetary policy to keep inflation in a 3%-6% range though it has breached the upper target when short-term inflation shocks are experienced because of sudden rand depreciation or other events.

Given the current political climate, there is considerable risk to the exchange rate that could flow from unexpected events around the ANC’s December conference to elect new leadership. Further downgrades of the government’s credit rating would also be exchange rate negative. A weaker rand would lead to higher prices for imported goods and given the large current account deficit, that would be inflationary.

General interest rates can also affect the value of inflation-linked bonds. If market rates unexpectedly rise to higher margins above inflation, then short term interest bearing assets become more attractive to investors than inflation-linked bonds. That means the prices of inflation-linked bonds will fall in the market, as well as longer-dated fixed interest securities.

Key facts

Suitability: This ETF is suitable for most investors wanting to protect their buying power. If can be used tactically as part of an investment strategy: you think inflation is going to unexpectedly increase in the short term you can increase your exposure, and sell when you think inflation is going to ease.

Risks: The most common risks associated with inflation-linked fixed-income securities are credit risk and interest rate changes. Fortunately, all the constituents of this fund are sovereign bonds issued by the SA government, which means credit risk is minimal. Real interest rate risk arises from fluctuating real interest rates. As real interest rates rise, bond prices fall and vice versa.

Alternatives: Retail investors seeking exposure to inflation-linked fixed income assets have two other options: NewFunds ILBI ETF (TER : 0.35%); and Satrix ILBI (expected TER: 0.25%).

BACKGROUND: Exchange-traded funds (ETFs)

Exchange Traded Funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets (in this case, US companies). They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to more than one company in a single transaction. ETFs can be traded through your broker the same way as shares, say, on the EasyEquities platform. In addition, it qualifies for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

Disclaimer

This research report was issued by . Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of . Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing [email protected]. Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

✖