Investing in turbulent times – how to weather the storms

Related Articles

16 August 2016 | Anil Jugmohan

When it comes to investing in the current turbulent markets, knowing what to do to protect and grow your wealth can be extremely confusing. However, Anil Jugmohan, Investment Analyst at Nedgroup Investments says the most important thing to remember when it comes to investing in times like these is to take advantage of those things that are within your control and to stick to your financial plan for the long-term.

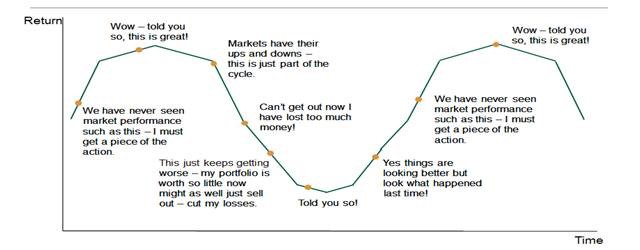

“The biggest mistake investors make is to react to short-term speculation and hype, and to try to time the market. Making investment decisions in this way usually results in investing or disinvesting at the wrong points in a market cycle. This can have significant negative financial consequences,” he says.

In fact, Jugmohan says, global research shows that the average investor’s return in equity funds, measured over time, is significantly (5% p.a.) below the average equity fund return. To explain the gap between investor returns and fund returns (on average), Jugmohan uses the below graph which illustrates typical investor reactions to market movements.

“They key to overcoming this damaging cycle is simple. Stay the course for the long term and do not react to short-term speculation and emotion,” says Jugmohan.

According to Jugmohan, being invested appropriately means accepting a certain level of risk in line with your financial goals and timeframe.

“It is nearly impossible to achieve even the most impressive long term returns without experiencing sometimes severe declines along the way. However, our experience shows that losses are temporary and more often it is the emotional reaction to these dips that locks in the loss. An investor who can stay the course and accept that losses are a part of the journey, will go a long way to eliminating the investor return gap compared to the average fund,” he says.

The bottom line is that no-one enjoys volatile markets. So what can an investor do to help navigate the emotional storm that is investing? Jugmohan gives the following advice:

- The first step is to ensure you are invested in sound investments managed by reputable managers.

- Get used to the idea of short-term market movements and movement in your portfolio – there is little value in trying to read too deeply into daily or even weekly moves. A monthly review is usually enough if you are investing longer-term – and a financial advisor can help you with this.

- Do not try to time the market. Rather, develop a structured plan around the important investment elements that you can control. These include:

- Your investment objectives

- The time horizon to achieve your objectives

- Your investment strategy

- The risk you need to accept in order to achieve your goals – and whether you can tolerate this level of risk

- Do not try to chase performance. Short-term returns are not a reliable indicator of future performance. Instead, look for security in the selection of a reputable fund manager with a long-term track record.

- Consider in advance how you would react to a market dip. This will help you stay calm and stick to your plan when a market fall does eventually occur.

- Employ a financial advisor who can guide your behaviour and assist with decision making, particularly during times of market stress.