The ETF Monthly Review: August 2018

Related Articles

The ETF Monthly Review

Welcome to this month’s ETF Review, a neat update of market news affecting ETFs, as well as a set of favourite funds chosen by the Intellidex team. We collaborate with Intellidex to bring you the latest insights on ETFs – probably the niftiest way to invest!

IN THIS ISSUE:

What’s happened in the markets?

- US economy maintains strong momentum

- Trade tensions escalating

- SA economy contracts in first quarter

Our favourite ETFs

- Domestic equities: Satrix Quality SA ETF

- Foreign equities: Satrix MSCI World ETF and Satrix MSCI Emerging Markets

- Bonds & cash: NewFunds TRACI 3 Month (short term); Satrix ILBI ETF, Stanlib Global Bond ETF & Ashburton World Government Bond ETF (long term)

- Dividend or income funds: Satrix Property ETF

News flash: Apple hits the $1trn mark

Apple, which dominates most international ETFs, became the first company in history to reach a market capitalisation with 12 zeros in dollars. $1,000,000,000,000.

What’s happened in the markets?

ETFs remained largely flat in July with an equally weighted portfolio of the 64 ETFs that we cover marginally losing 0.43%. However, the one-year performance to end-July remained positive, up 4.5%. Local-asset ETFs gained marginally, rising 0.64%, in tandem with mixed economic data, while the international ones were negative, losing 2.23%, as the rand recovered some of its June losses. The rand was buttressed by China’s plans to invest about $15bn in SA while Eskom secured a R33bn loan from the China Development Bank.

Local funds and markets:

The top 40 index – the universe for most of local equity ETFs – retreated 0.33%. However, the Satrix Quality, Satrix Rafi and Coreshares Top 40 Equally Weighted funds showed relatively better metrics among the broad-based funds, edging up 3.3%, 2.1% and 2.4% respectively.

Overall, the star performers were the Satrix Fini 15 (up 6.5%) and Coreshares S&P SA Dividend Aristocrats (up 5.9%). Noticeable weaknesses emanated from the property sector with the Coreshares Proptrax Ten and Satrix Property both declining by 1.8%.

The rand closed July stronger due to an improved trade balance and the proposed investments from China – although comments by President Cyril Ramaphosa regarding land expropriation erased some of the rand gains.

Intellidex’s favourite ETFs

Each month the investment gurus at Intellidex scan the market to come up with a list of their favourites.

Phibion Makuwerere, explains:

We classify all ETFs into five broad categories:

- domestic equities

- international equities

- bonds and cash

- multi-asset

- dividend or income-focused

Various empirical studies show that the bulk of equity returns stem from diversification among broad asset classes rather than to individual stock picking. As such, our grouping is done with a diversified portfolio in mind, ensuring appropriate exposure to different asset classes. First, we group the ETFs according to the three widely recognised asset classes – equities, bonds and cash. We

further split equities into geographic groupings. We then add a category for equity ETFs with an income theme.

Our picks in the above categories should provide an investor with a relatively diversified portfolio even if it was made up only of ETFs. However, asset allocation is not a one-size-fits-all concept – you want to choose asset classes that meet your unique risk and return objectives. Multi-asset ETFs, which are already diversified among asset classes, are analysed as a separate category.

As a rule of thumb, we like ETFs that follow a simple but watertight investment philosophy. They should also be tax smart, which means they should qualify to be in a tax-free savings account. To avoid over-concentration, a good ETF should cap its exposure to a single sector and/or a single counter. While costs may no longer be a big issue in developed markets where they have declined significantly and do not differ much across different products, they still are an issue in SA. We prefer ETFs with low total expense ratios (TERs).

An overview of our favourite funds for each category follows.

The August favourites:

Domestic equity: Satrix SA Quality ETF

Local equities have various themes including: broad-based, sector, and smart beta. However, our goal is to build a well-diversified and broad-based portfolio. The other themes can be introduced in a core-satellite portfolio.Satrix SA Quality remains our top choice and it was the best performer among broad-based ETFs in July, growing 3.33%. However, investors should be aware that equities are long-term investments because they exhibit higher volatility than cash and bonds.We like the Satrix Quality ETF because it reduces the concentration risk that has come to dominate the top 40 index because it caps the weight of each counter and sector.

The Absa purchasing managers index (PMI) crossed the important 50-point mark, rising to 51.5 from 47.9, suggesting that the manufacturing sector did well in the third quarter of 2018.

However, employment figures disappointed with the unemployment rate increasing to 27.2% during Q2 from 26.7% in Q1. Given that consumption – which feeds off the employment level – is the biggest component of our national income, the unemployment rate is worrying. Much-needed economic growth remains elusive and the Reserve Bank has since downgraded its 2018 growth forecasts to 1.2% from 1.7%. However, a recovery is expected in 2019, with growth of 1.9% expected, upwardly revised from 1.7%. But this is still too low for SA is to address its unemployment quagmire.

International funds and markets:

Except for the Sygnia/Itrix FTSE 100 which rose 3.7%, all international ETFs listed on the JSE ended July in the red. Global bond funds were the worst

The fund selects constituent companies using a set of quality metrics, including return on equity, liquidity and leverage. The top 20% of all JSE-listed companies with the highest scores based on those criteria are included in the fund and weighted by market capitalisation, then capped each at 10% of the fund. Empirical evidence shows that portfolios sorted on factors such as profitability and earnings quality generate high risk-adjusted returns relative to a market portfolio. However, the size of the premium varies, depending on the metrics used to calculate the quality score.

Foreign equities, developed markets: Satrix MSCI World ETF

The international equities offering of the JSE has been expanding. It started off with broad-based themes but has expanded into property funds and, more interestingly, technology funds.Again, our first priority is a broad-based fund. However, technology is a theme that is lacking in our local funds, and given its ever-increasing role in our lives, South African investors ought to gain increased exposure in technology funds to complete their portfolios and enhance sector diversification.

performers. Ashburton World Government .Bond and FirstRand US Dollar Custodian Certificate funds lost 5% and 5.3% respectively. The Coreshares S&P Global Property fund shed 4%.

The US economy is firmly in growth territory despite escalating trade wars with its major trading partners. This has put markets on the edge, but it would seem the opening of the US corporate reporting season had more to do with how the global markets ended in July. Facebook and Netflix were notable disappointments, announcing underwhelming results towards the end of July. In contrast Apple, which reported in the first week of August, breathed life into the markets.

The Federal Reserve kept rates unchanged while the US economy was estimated to have posted its biggest quarterly growth rate in Q2 since 2014, with 4.1% (from 2.2% in Q1). It was driven by consumer spending and business investment. However, the US’s flash IHS Markit PMI edged lower in July to 55.4 from 55.5 but remains firmly in positive territory. The barrage of strong data has increased the probability of a rate hike in September.

However, trade wars still pose significant downside risk. The US is considering imposing 25% (upwardly revised from 10%) tariffs on Chinese goods worth $200bn. In response, China announced it will take countermeasures.

The eurozone IHS Markit flash PMI started Q3 on a better footing, ticking up 0.2 points to 55.1 in July, after ebbing since the beginning of the year. Furthermore, the European Central Bank left the policy rate unchanged, as expected, but the Bank of England raised its interest rate by 25 basis points to 0.75% citing inflationary pressures.

Onthe growth front, the eurozone economy moderated to 0.3% in Q2 from 0.4% in Q1, its slowest rate in two years and slightly below market expectations.

In emerging markets, the Satrix MSCI Emerging Markets ETF decreased by 1.82% in July. The Chinese Caixin Composite PMI fell 0.7 index points to 52.3, weighed down by services and manufacturing. This is a 32-month low, perhaps highlighting the level of uncertainty posed by trade disputes wbetween China and the US. This points to a pending slowdown of the economy.

NEWS FLASH: Apple hits the $1-trillion market capitalisation mark

The biggest company in the world also became the first to hit the R1-trillion market cap mark in the first week of August after releasing market-pleasing results for its 3Q18. If you own the right international ETFs listed on the JSE you are participating in this growth already. Other big tech giants such as Amazon and Google are not too far behind. There are a number of ETFs listed on the JSE that can also give you exposure to these companies (see our discussion of foreign equities funds alongside).

[Ends]

has expanded into property funds and, more interestingly, technology funds. Again, our first priority is a broad-based fund. However, technology is a theme that is lacking in our local funds, and given its ever-increasing role in our lives, South African investors ought to gain increased exposure in technology funds to complete their portfolios and enhance sector diversification. Three new technology theme funds are: Sygnia/Itrix 4th Industrial Revolution; Stanlib S&P 500 Info Tech Index Feeder; and Satrix Nasdaq 100.

However, our anchor portfolio in the international ETF category is the newer Satrix MSCI World ETF (down 1.84% in July). It displaced the Ashburton Global 1200 (down 1.55% in July) in our last monthly review due to a better expense ratio of 0.35%. The Satrix MSCI fund has exposure in the developed markets of the US, Europe, Japan, Canada and Australia.

Foreign equities, developing markets: Satrix MSCI Emerging Markets ETF

The choice in this segment is limited to two funds: Satrix MSCI Emerging Markets (down 1.82% in July) and the Cloud Atlas AMI Big50 (down 5.84% in July). Our choice for Satrix MSCI Emerging Markets is motivated by its diversification. The fund provides exposure to high-growth economies such as China and India, which are not included in any of the developed market funds, thus offering further diversification. The Satrix MSCI Emerging Markets ETF with a TER of 0.4% tracks the MSCI Emerging Markets Investable Markets index, which captures companies across 23 countries. The Cloud Atlas AMI Big50 fund has a higher TER of 0.75%.

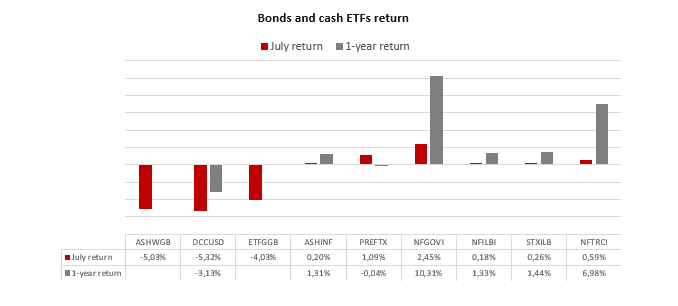

Bond and cash funds

Bonds and cash are good additions to portfolios not only because of their diversification qualities but also for their ability to enhance returns. The recent launch of two new ETFs by Stanlib and Ashburton that track foreign sovereign bond markets widens the choice in the segment.

If you are investing for a very short period, usually less than a year, then the NewFunds TRACI 3 Month (marginally up 0.59% in July) is a natural choice

because it is least sensitive to sudden adverse interest rate movements. It is similar to earning interest on your cash at the bank with a minimal possibility of capital loss.

However, for a longer investment horizon, protecting your investment against inflation is paramount. We therefore maintain our choice of the Satrix ILBI ETF (up 0.26% in July) which has the lowest expense ratio in this category. Furthermore, nominal bonds add a unique risk-return dimension that differs from inflation-linked bonds and improves overall portfolio performance.

In addition to the local bond ETFs, investors now have an option to choose from foreign bond ETFs on the JSE: Stanlib Global Bond ETF, Ashburton World Government Bond ETF and the FirstRand Dollar Custodian Certificate ETF. Of the three we are undecided between the Stanlib Global Bond ETF and Ashburton World Government Bond ETF. Both are feeder funds that track the performance of fixed-rate, local currency, investment-grade sovereign bonds. These are mostly issued by the US, UK Japan, and selected European countries. Their TERs differ by just 0.05 percentage points with the Stanlib Global Bond ETF being the cheapest.

Dividend or income theme funds

If you rely on your investment income for day-to-day expenses you may want to allocate a portion of your portfolio to ETFs that have a high distribution ratio. Naturally, Satrix Dividend Plus and CoreShares S&P South Africa Dividend Aristocrats come to mind here, but similarly, property funds are high dividend payers.

There are two investable property indices available: SA listed property and the capped property index. We maintain our choice of the capped fund Satrix Property ETF (down 1.76% in July), with lowest expected TER in the segment. However, investors with a stomach for exchange rate volatility can consider foreign property ETFs. The Sygnia Itrix Global Property ETF (down 3.9% in July), with a TER of 0.25%, is by far the cheapest of the three.

Multi-asset ETFs

If you find the process of diversifying your portfolio daunting, two ETFs do it for you. They combine equities and bonds to produce a diversified portfolio for two investor archetypes. They are the NewFunds Mapps Protect ETF and the NewFunds Mapps Growth ETF. They are designed to meet two different risk appetites: Mapps Protect is more conservative, suitable for conservative, usually older, savers. Mapps Growth suits investors with a long-term horizon. They rose 0.46% and 0.28% respectively in July.