CoreShares S&P South Africa Low Volatility

Related Articles

Suitability: This ETF that invests in equities but boasts low volatility, reducing the risk profile. By default, it has a two-stage screening process (explained below). Any stock that winds up in the fund first has to pass the S&P SA Composite Index criteria as well as the S&P SA Low Volatility Index methodology. As such the fund is composed of assets that meet stringent yardsticks for liquidity, market capitalisation and volatility. So the fund inherently has low volatility, which diminishes its relative risk profile while still exposing an investor to the potential high returns associated with equity investments. Boosting the fund’s attractiveness are empirical studies that show that high volatility stocks tend to underperform. This fund, therefore, should suit people who can stomach some degree of risk due to the equity exposure, to use as part of their core long-term portfolio.

What it does: The CoreShares S&P South Africa Low Volatility ETF tracks the price and yield performance of the S&P SA Low Volatility Index (volatility index). As mentioned, the fund has two screening stages. First, all JSE companies are subjected to the S&P SA Composite Index screening. From those that pass the composite test, the 40 least volatile stocks are used to make up the S&P SA Low Volatility Index.

The composite index consists of all JSE-listed companies with significant SA operations that meet certain minimum liquidity and market capitalisation requirements. The market cap is adjusted for stocks held by company sponsors, founders and the government. The volatility index is then made up of the 40 least volatile stocks from the composite index, based on their one year trailing standard deviation. Standard deviation is measured as a security’s daily price returns variability over the past year. These low-volatility stocks are then weighted by the inverse of their volatility, ie, the company with the lowest volatility has the highest weighting and the company with the highest volatility has the lowest weighting.

In finance, volatility (as measured by standard deviation of an asset) is widely used to measure risk. The interpretation is that a low measure of standard deviation (low volatility) means the risk of an asset is low and vice versa.

Advantages: Compared with most listed ETFs which limit their universe to the JSE’s top 100 or fewer stocks, this fund has a wider universe which encompasses all JSE-listed stocks (large-, mid- and small-caps) that meet the S&P SA Composite Index criteria. The fund is also well diversified with the biggest asset taking up only 3.4% of the fund. This eliminates the idiosyncratic influence of individual stocks, compared with popular market cap-weighted approaches.

Risk: This is a 100% investment in equities, which remains a riskier asset class than bonds or cash – but the fund is less volatile than other equity investments.

Fees: The annualised total expense ratio (excluding brokerage and transactional costs) is 0.41%.

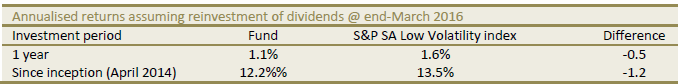

Historical performance: The fund’s performance depends on how you choose to invest – through a single lump-sum payment or regular instalments. A lump-sum investment mimics the index performance more closely and the performance report in the table below is for a lump-sum investment.

Alternatives: There are no available listed ETFs which track the S&P SA Low Volatility Index.