ETF review – Spotlight on Intellidex’s favourite funds

Related Articles

Intellidex | 3 October 2017

Every month our colleagues at Intellidex choose a few exchange-traded funds they believe are the best in the market in each asset class for clients of EasyEquities. We publish their selection here.

Fund managers are taking the exchange traded funds (ETF) market more seriously. A raft of new ETFs have been listed on the JSE since the beginning of the year and we are likely to see eight more before the year closes.

This trend serves investors well. It provides a wider variety to choose from in terms of ETF strategies as well as choices within each strategy. Increased competition also seems to be forcing providers to reduce costs. Satrix has taken the lead: it has capped the total expense ratio (TER) for its flagship Satrix 40 fund at just 0.1% from 0.38% previously. Most of its new offerings are also cheaper than existing products.

While greater choice is fantastic, it does make it more difficult to decide on which are best to meet the needs of particular investors. We have studied all the ETFs and chose the ones we believe have the best potential. We classify all the ETFs into five categories: domestic equity; international equity; bonds and cash; multi-asset; and dividend-focused. Not all categories are right for investors and you would want to choose asset classes that meet your objectives: domestic and international equities for long-term higher risk/return strategies, and dividend-focused, multi-asset, or bonds/cash strategies for increasingly lower risk strategies.

We select our favourites based on costs, strategy and diversification. We believe a good ETF should be cheap. Cost differences, while appearing small on paper, can make a huge impact on an investor’s returns when compounded over time. We also prefer ETFs which avoid fancy strategies that are difficult to understand. They should follow indices that make sense. A good ETF should also be tax-smart. In this case, it should qualify to be in a tax-free savings account. To avoid overconcentration, a good ETF should cap its exposure to a single sector and or a single counter. Below we provide an overview of each of our favourite funds for each category.

Domestic equity

There are now more than 24 products in this segment tracking a range of indices. In our last review of our favourite funds, we indicated that we preferred ones that broadly track the JSE’s top 40 index, particularly the Swix index which focuses on those companies that have SA-based shares. However, the delisting of SABMiller earlier this year has left the top 40 portfolios disproportionately overweight in a few stocks, which makes them undesirable from a diversification point of view. The top 10 holdings now constitute about 60% of the overall index. Naspers alone accounts for a quarter of the JSE Swix 40 and about a fifth of the JSE top 40 index. More than a third of the top 40 index’s returns over the past five years came from Naspers. The danger with such concentration is that if Naspers takes a dive, the ETFs that track the index will go down with it.

Largely because of that we change our choice in this category to the recently listed Satrix SA Quality ETF. It’s not the cheapest in the segment but it has potential to offer investors diversified exposure to the entire market. Unlike the top 40 indices, the S&P Quality SA index is not only based on market capitalisation – it caps the weight of each counter and sector in the fund. The fund scores most companies in the market using a set of quality metrics, including the return-on-equity, liquidity and the leverage of the companies’ balance sheets. It then includes the top 20% based on these scores and weights them by market cap, up to the cap applied. The outperformance of high-quality stocks over low-quality stocks is well-documented in financial research. Empirical evidence shows that portfolios sorted on factors such as profitability and earnings quality generate high risk-adjusted returns relative to the market portfolio or a multi-factor model, but the size of the premium varies, depending on the metrics used to calculate the quality score.

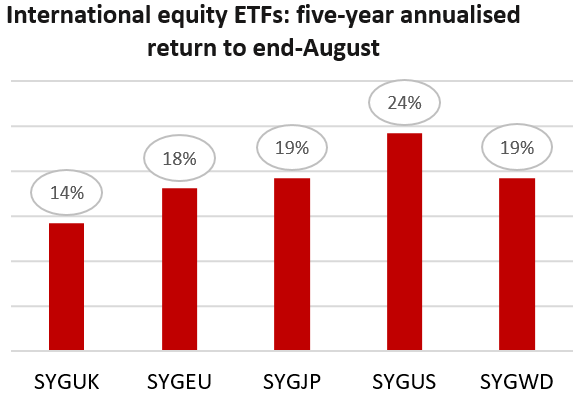

There have been a lot of changes in this category since our last review. Deutsche Bank, which used to be the only player in the segment, sold its five ETF offerings to Sygnia. Sygnia has promised to slash the costs of operating and distributing these products. Satrix and Cloud Atlas have also introduced new ETFs which track emerging markets and global property indices which haven’t previously been available. We still prefer indices that track US stock markets – the MSCI USA and S&P 500 indices. The main advantage with these is that despite being listed in the US, they offer good exposure to the rest of the world. Roughly 44% of earnings of the S&P 500 comes from Europe, Asia the Americas and a little bit from Africa. Given the similarity between the ETFs that track the S&P 500 and MSCI USA, our choice is decided by the costs. The newly listed Satrix S&P 500 is targeting a TER of 0.25% which, if achieved, will be a fraction of its competitors. We think that could make a significant difference in terms of the returns investors will get from this ETF, so that makes it our favourite.

Bond and cash funds

Bonds and cash are good additions to portfolios not only because of their diversification qualities but also for their ability to enhance returns. There are now six (including the recently listed Satrix ILBI) listed funds in this category:

(i) NewFunds GOVI ETF;

(ii) NewFunds ILBI ETF;

(iii) NewFunds TRACI 3 Month ETF;

(iv) Ashburton Government Inflation ETF;

(v) Satrix ILBI ETF;

(vi) CoreShares PrefTrax.

They each track different things: (i) tracks government bonds; (ii), (iv) & (v) track inflation-linked government bonds; (iii) tracks short-term money market instruments and (vi) tracks listed preference shares.

If you are investing for a very short period, usually less than a year, then the NewFunds TRACI 3 Month (NFTRCI) is a natural choice, because it is least sensitive to sudden adverse interest rate movements. It is similar to just earning interest on your cash with minimal possibility of capital loss.

However, for a longer investment horizon, the motivation is to protect against inflation – particularly in emerging markets where various external and internal variables can substantially drive up prices. Because the Satrix ILBI ETF promises to have the lowest expense ratio of 0.22%, it is our choice here. It does not have a performance history as it was launched recently, but should mimic the performance of other inflation-linked bond funds.

Dividend-focused funds

While the obvious choice for an investor seeking a good stream of dividends will be ETFs that filter potential investments based on dividend yields (such as Satrix Dividend Plus ETF and CoreShares S&P South Africa Dividend Aristocrats), we believe investment options should be considered on a total return basis. Total returns combine both capital growth and dividend yield. As a result, we don’t think Satrix Dividend Plus and CoreShares S&P South Africa Dividend Aristocrats should get uncontested consideration in this category. We think investors looking for stable dividend income are better off investing in property funds. Historically, property stocks have offered superior dividend yields as well as decent capital gains. There are two investable property indices available: SA listed property and the capped property index. We like the capped one because it avoids a situation where a few big counters dominate a fund – as is the case with the uncapped index. Of the two ETFs that track the capped index, we prefer the newly listed Satrix Property ETF. The fund has a TER of 0.30%, which makes it the cheapest in the segment.

Diversified funds

Equities are regarded as the financial asset class that carry the most risk. They generally provide the best returns over time, which compensates for the high short-term risk, so they are more suited to longer-term investors.

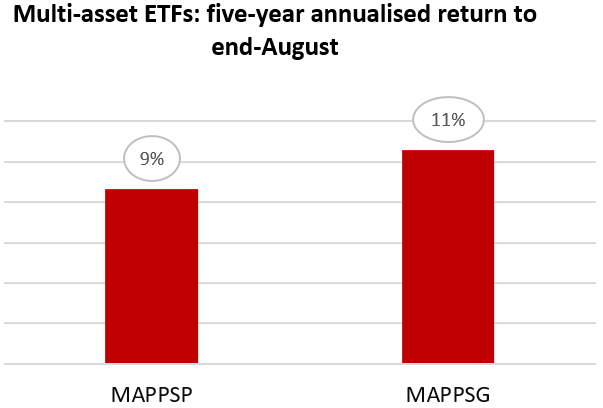

One way to reduce that risk is to invest in funds that include other asset classes such as bonds and cash. Two good funds for this are the NewFunds MAPPS Protect ETF and the NewFunds MAPPS Growth ETF.

They are designed to meet two different risk appetites: Protect is more conservative, suitable for older savers nearing retirement. Growth suits younger savers with a long-term horizon.

Please see accompanying document for JSE codes for each ETF.

Disclaimer

This research report was issued by . Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of . Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing [email protected]. Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

✖