New ETF tax-free savings account launched

Story Highlights

- ETFSA Tax Free Savings Account

- NEW ETF TAX FREE INVESTMENT ACCOUNTS LAUNCHED

Related Articles

Press Release

A new tax free product, using only Exchange Traded Funds (ETFs) as the investment constituents, has been launched by Computershare (Pty) Ltd as the administrators, and etfSA.co.za as the portfolio managers and financial advisors.

The new tax free investment accounts fully comply with the new tax concessions, conditions and requirements announced in the Budget Speech last month and introduced from 1st March 2015, under Section 12T of the Income Tax Act.

The ETF Tax Free Investment Accounts (ETFIA) are distinctive from other products in focusing purely on investment accounts and for using only ETFs in portfolio construction. The new tax free accounts will incur a maximum charge of 1% per annum for administration and portfolio management, making them a highly cost effective product in this competitive environment.

Mike Brown, Managing Director of etfSA.co.za states that “ETFs are ideal for the tax free schemes, as they pay a very high percentage of income received, through to clients as dividends or interest, so the tax free impact of reinvested income is maximised and also allow for capital growth strategies to be effectively pursued through a balanced portfolio of ETFs, focusing on a strategic asset allocation strategy. “

The ETF Investment Accounts will offer two distinct portfolio options, or the investor can choose a combination of the two options.

ETF TAX FREE INCOME ACCOUNT

| Historic Investment Performance to Feb-2015 | ||||||

| 1 Year (%) | 2 Years (% p.a.) | 3 Years (% p.a.) | 5 Years (% p.a.) | Average (% p.a.) | ||

| ETF Income Account* | 20,9% | 9,1% | 12,2% | 12,4% | 13,7% | |

| SA Government Bond Index | 15,2% | 6,7% | 9,3% | 10,3% | 10,4% | |

| Money Market Index | 6,1% | 5,7% | 5,6% | 5,8% | 5,8% | |

| Source: | JSE/Profile Data (27/2/2015). | |||||

| * Note: | This is the past performance of a portfolio of the selected ETFs, had tax-free legislation been in place since 2010. The same historic returns may not be achieved in future. | |||||

This is a low risk income bearing tax free account, with income growth rather than capital gains being the key objective. It gives a clear total return advantage to fixed income Government bonds or money market savings accounts on a historic investment return basis.

ETF TAX FREE EQUITY ACCOUNT

| Historic Investment Performance to Feb-2015 | ||||||

| 1 Year (%) | 2 Years (% p.a.) | 3 Years (% p.a.) | 5 Years (% p.a.) | Average (% p.a.) | ||

| ETF Equity Account | 31,4% | 28,3% | 28,3% | 23,6% | 27,9% | |

| JSE All Share Index | 16,8% | 20,1% | 19,9% | 18,2% | 18,8% | |

| Source: | JSE/Profile Data (27/2/2015). | |||||

| * Note: | This is the past performance of a portfolio of the selected ETFs, had tax-free legislation been in place since 2010. The same historic returns may not be achieved in future. | |||||

This is a higher risk portfolio with the intention of generating tax free capital growth over time. As can be seen the portfolio has generated a return of nearly 28% per annum over the past 5 years, based on historic investment performance, which, of course, might not necessarily be replicated in future.

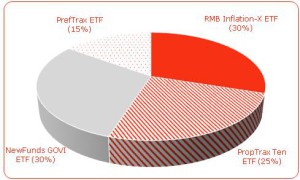

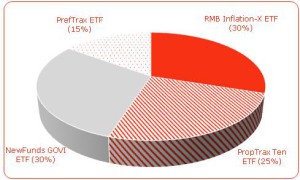

Nerina Visser, director of etfSA.co.za, comments on the portfolio allocation as follows.

“We have focused on constructing ETF portfolios for clients with the following core objectives:

- Using multiple ETFs to give a balanced strategic asset allocation portfolio.

- Focussing on low volatility portfolios to generate long-term growth with limited standard deviation risk.

- Reducing the concentration risk of the portfolios, by limiting the allocation to any single share on an aggregated basis. For instance, in the equity tax free account, the maximum exposure to any single share is less than 4% of the total portfolio.

- Selecting only liquid, low cost ETFs for inclusion in portfolios.”

A major benefit of tax free investment accounts, relative to tax free savings accounts, is the potential they provide for long-term accumulation of capital, which can then be withdrawn on a tax free basis, as shown in the table below.

| What Return Can I Expect?R30 000 p.a. investment to a maximum of R500 000 | |||

| 1 Year | 5 Years | 17 Years | |

| Cash (bank savings) | R31 740 | R208 208 | R899 796 |

| SA Government Bonds | R33 120 | R233 817 | R1 413 647 |

| ETFIA – Income Account | R34 110 | R254 133 | R1 979 479 |

| JSE All Share Index | R35 640 | R289 028 | R3 375 777 |

| ETFIA – Equity Account | R38 370 | R363 169 | R8 902 064 |

| Based on the average return of the last five years to Feb-2015. The same return may not be achieved in future. | |||

For more information on the ETF Tax Free Investment Accounts, please contact:

| Nerina Visser | [email protected] | 011 274 6173 |

| Mike Brown | [email protected] | 011 274 6171 |